|

|

|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

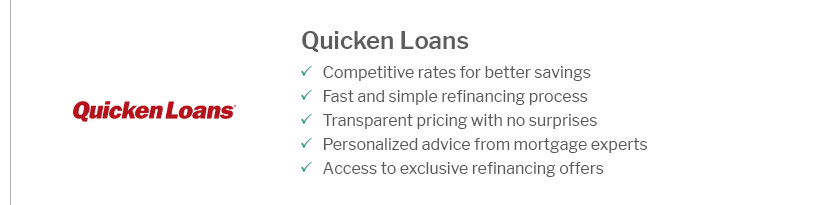

Exploring the Top Mortgage Companies: A Guide to Making Informed DecisionsIn the complex landscape of home financing, finding the right mortgage company can be a daunting yet crucial task. The multitude of options available can often leave potential homeowners feeling overwhelmed. Therefore, understanding what makes certain mortgage companies stand out is essential for making an informed choice. When we talk about top mortgage companies, we refer to those that consistently demonstrate reliability, offer competitive rates, and provide exceptional customer service. These firms are recognized for their ability to simplify the otherwise intricate process of securing a mortgage, thereby easing the path to homeownership. Factors to Consider To begin with, interest rates play a significant role in determining the cost-effectiveness of a mortgage. While it might be tempting to opt for the company offering the lowest rates, it's crucial to consider the broader picture. Hidden fees and terms, which may not be immediately apparent, can significantly affect the overall cost. Thus, transparency in fees and terms should be a key consideration when evaluating mortgage companies. Customer service is another critical factor. The best mortgage companies are those that prioritize their clients' needs, providing timely and clear communication throughout the process. This not only builds trust but also ensures that clients are well-informed about each step of their mortgage journey. Moreover, companies that offer personalized advice tailored to an individual's financial situation often deliver a superior service. Technology and accessibility are also essential considerations. In today's digital age, the convenience of online applications and mobile app functionality can greatly enhance the mortgage experience. Companies that invest in technology to streamline processes and improve accessibility often stand out as leaders in the industry. Leaders in the Industry Several mortgage companies have established themselves as leaders through their comprehensive offerings and customer-centric approaches. Quicken Loans, now known as Rocket Mortgage, is renowned for its innovative use of technology, allowing customers to navigate the mortgage process with ease from the comfort of their homes. Meanwhile, Wells Fargo, despite facing challenges in the past, continues to be a major player due to its extensive range of mortgage products and nationwide presence. Additionally, Bank of America is noteworthy for its commitment to providing affordable loan options and homebuyer education, catering to first-time buyers and low-to-moderate-income borrowers. Furthermore, Chase offers an array of mortgage options and benefits for existing customers, making it a popular choice for those who prefer to consolidate their banking and mortgage needs under one roof. The Importance of Staying Well-Informed Ultimately, the importance of staying well-informed cannot be overstated. The mortgage industry is dynamic, with rates and terms frequently changing. Prospective homeowners should take the time to research and compare multiple companies, considering both the quantitative aspects like rates and fees and the qualitative aspects such as customer service and accessibility. Engaging with customer reviews and seeking advice from financial advisors can provide additional insights, helping individuals to align their choices with their long-term financial goals. By carefully evaluating these factors, homeowners can secure a mortgage that not only meets their immediate needs but also supports their financial well-being in the years to come. In conclusion, while the task of choosing the right mortgage company may seem formidable, being equipped with the right knowledge and considerations can transform this challenge into an opportunity. The top mortgage companies are those that not only offer competitive rates but also commit to enhancing the overall customer experience through transparency, technology, and personalized service. By focusing on these elements, prospective homeowners can navigate the mortgage process with confidence and clarity. https://www.experian.com/blogs/ask-experian/largest-mortgage-lenders/

10 Largest Mortgage Lenders in the US - 1. Rocket Mortgage - 2. United Wholesale Mortgage - 3. Bank of America - 4. Fairway Independent Mortgage - 5. https://www.businessinsider.com/personal-finance/mortgages/best-mortgage-lenders

Our top pick mortgage lender is Bank of America, but that doesn't mean it's the best bank for you to get a mortgage from. The best mortgage ... https://www.nationalmortgagenews.com/list/best-mortgage-companies-to-work-for-2025

Developer's Mortgage Company. Location: Columbus, Ohio Number of employees: 81. Website: www.developersmortgage.com. Developer's Mortgage ...

|

|---|